irs tax levy calculator

Pay Period Frequency select one Select from below. From Simple To Complex Taxes Filing With TurboTax Is Easy.

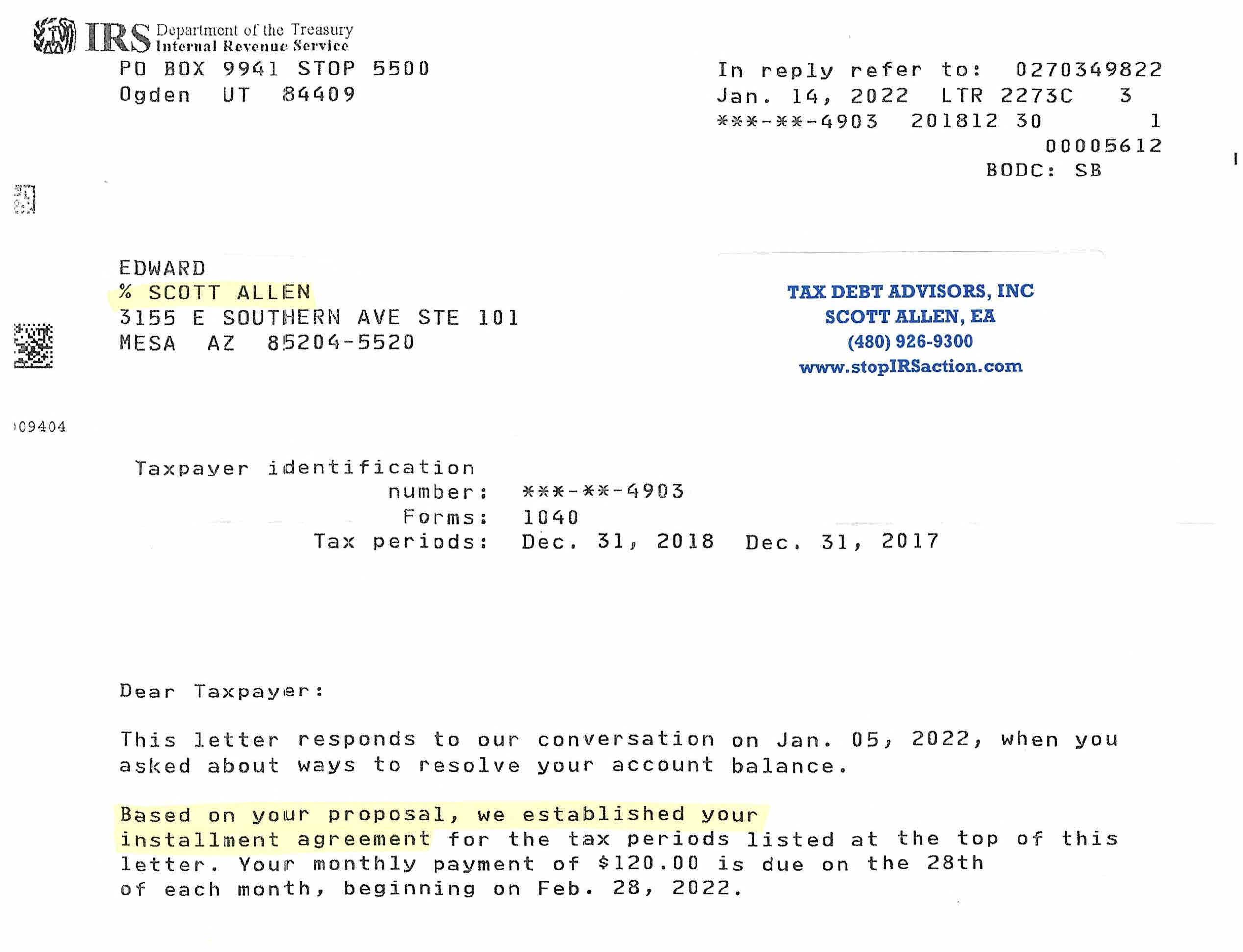

Irs Tax Notices Explained Landmark Tax Group

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related.

. TaxInterest is the standard that helps you calculate the correct amounts. The IRS provides a wage garnishment calculator to determine the correct amount of wages to be withheld from an employees paycheck. For the sake of brevity and general.

The IRS can take as much as 70 of. With a tax levy the IRS confiscates assets of yours such as the money in your savings account or a portion of your wages. Click on Click Here for the Levy Calculator in red above the top blue line.

It can garnish wages take money in your bank or other financial account seize and sell your. Enter mils for new levy. When an individual has outstanding federal tax liabilities the Internal Revenue Service IRS has a number of tools at its disposal to try to collect the liabilities from the.

See What Credits and Deductions Apply to You. Failure to pay federal taxes can result in the IRS levying the delinquent taxpayers property such as home car or boat or rights. 46385 plus 35 of the amount over 209400.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. How to calculate the minimum monthly payment individuals only based on IRS thresholds.

As an employer when you receive a notice of levy from the federal government youll need to calculate the amount of the employees pay. An IRS levy permits the legal seizure of your property to satisfy a tax debt. You make other arrangements to pay your overdue taxes The amount of.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. It is different from a lien while a lien makes a claim to your assets as. Which bracket you land in depends on.

How to Calculate Payroll With a Levy From the IRS. The consequences of a bank levy or wage garnishment can impact your credit score though. Ad Answer Simple Questions About Your Life And We Do The Rest.

Ad Answer Simple Questions About Your Life And We Do The Rest. Of course an IRS levy doesnt happen overnight. Enter dollar amounts without commas or.

156355 plus 37 of the amount over 523600. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Enter Your Tax Information.

By using this site you agree to the use of cookies. File With Confidence Today. We have been helping individuals and small business.

In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on any outstanding penalties. Calculator OORAA Debt Relief is proud to be an expert in debt settlement with one of the most experienced teams in the industry. Check whether property is residential agricultural or commercial.

File With Confidence Today. A tax levy itself should not directly affect your credit score since IRS levies are not public record. How to Calculate Wage Tax Levy.

Follow steps 1-4 to calculate disposable pay. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. 10000 25000 and 50000 or less owed.

If the IRS levies seizes your wages part of your wages will be sent to the IRS each pay period until. From Simple To Complex Taxes Filing With TurboTax Is Easy. If the levy is 42 mils.

Irs Tax Brackets Here S How Much You Ll Pay In 2021 On What You Earned In 2020

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Do You Have Back Tax Returns That Are Unfiled Thecpataxproblemsolver Is Ready To Help You Know More Https Cstu Io B01fdf Sc Irs Taxes Tax Prep Tax Debt

Find Out Where You Can File A Taxreturn For Free Online The Freefilealliance Has Several Options Irs Fileonl Filing Taxes Free Tax Filing Tax Preparation

Irs Bank Levy Flat Fee Irs Tax Relief Florida United States Irs Taxes Irs Tax Debt

Stop A Tax Levy At Ooraa Irs Taxes Tax Debt Tax Payment Plan

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Irs Taxes Tax Debt Tax Debt Relief

Winchester Va Irs Tax Problems Help Kilmer Associates Cpa P C

Tax Attorney Tax Lawyer Tax Attorney Good Lawyers

Turning In U S Tax Cheats And Getting Paid For It Don T Mess With Taxes

Reports Show That The Irs Has Mistakenly Paid Out Billions In The Past Decade To Identity Thieves And People Who Fraudulently Claim Irs Taxes Tax Debt Tax Help

Payroll Tax Definition Payroll Taxes Payroll Tax Attorney

Itr Filing Online Online Taxes Online Online Journal

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Tax Brackets Here S How Much You Ll Pay In 2021 On What You Earned In 2020

Back Tax Returns Tax Debt Advisors

What Does It Mean To Be Tax Exempted Mortgage Payoff Irs Taxes Income Tax